Jun 17, 2019 | EMILY BAKER-GAUNT

If you’re thinking of selling your business you need to start getting ready early. From experience we suggest taking preparatory steps at least two years in advance. Here, our experienced Corporate Finance team talk you though the process of selling a business:

We always start by understanding your personal objectives. That could be retaining family control, passing the business on to its managers, realising the highest price – or something else entirely. Many entrepreneurs want to leave behind them a legacy that retains the unique culture and identity of the business. We’ll work with you to review your company’s situation and then, together, we’ll structure a strategic plan for a smooth exit.

The right exit strategy, meticulous preparation, deep insights and clear articulation of the strengths of your business, along with finding the right buyer or investor, are the critical elements of a successful exit. We pride ourselves on being able to deliver all of this to secure the very best results for you.

We don’t just advise on selling businesses. You might want to secure investment to help grow your business. You and your management team might want to acquire the company you work for. Or, you might want to find the best funding package or private equity investment available.

Whatever it is that you need, we have a proven track record of completing deals for privately owned businesses of all sizes across many sectors.

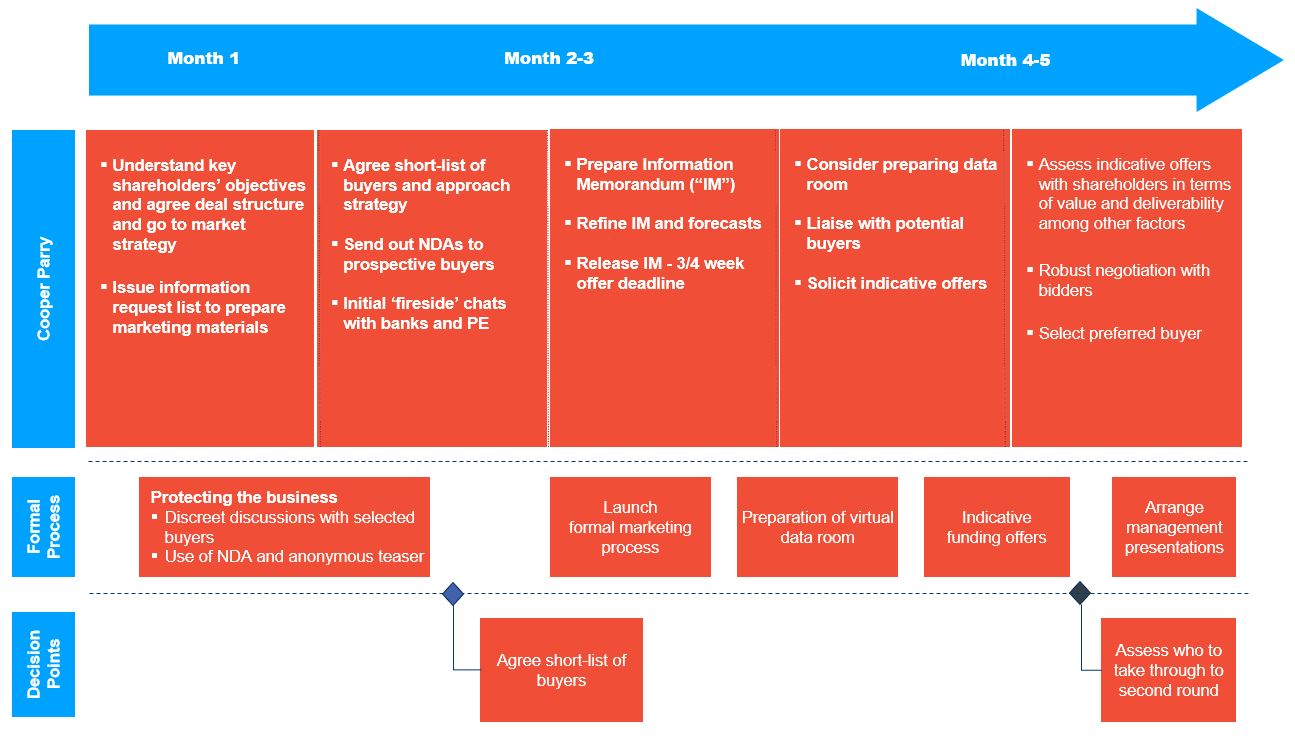

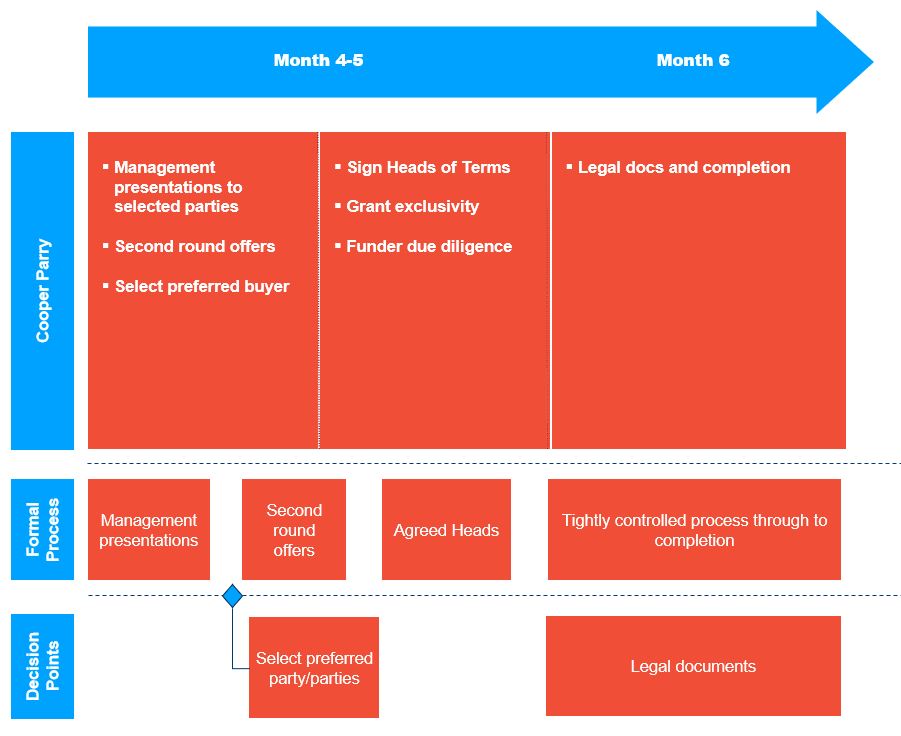

Each of the major stages are detailed below:

Stage 1: Strategic review and research to identify potential purchasers

Potential Purchasers are identified utilising various research tools and, where appropriate, by discreet enquiries through our own network of contacts. We discuss our research on potential purchasers (including any which you may suggest) with you before agreeing a short list of the most appropriate parties to approach.

Stage 2: Preparation of an Information Memorandum

We’ll work with you to prepare an Information Memorandum (“IM”) which will form the transaction’s principal marketing document. This document will provide interested parties with the company’s history and details of its activities, assets and its past, current and forecast financial performance.

Stage 3: Contacting short-listed parties

Once the IM has been finalised, we will seek your approval to contact the agreed short-list of additional parties.

The IM will only be released after we’ve received a confidentiality agreement and we would stress the need for total confidentiality. Direct approaches to the company’s staff, customers or suppliers will not be permitted.

Stage 4: Developing relationships with interested parties and evaluation of interest

We develop a relationship with interested parties, taking questions and determining their degree of interest.

The covering letter which accompanies the IM will set out the sale procedure and invite interested parties to make indicative offers.

Stage 5: Selection of a preferred bidder

On receiving indicative offers we’ll discuss their features with you and help to evaluate alternative deal structures. Together, we will negotiate further with the offerors.

This stage of the process may also involve you, and the management team, making presentations to offerors. Where this is the case, we assist in the drafting of appropriate presentations and advise you on the manner and tone of their delivery.

A preferred bidder should emerge and it is normal to grant a period of exclusivity during which final due diligence procedures can be carried out. Before granting any period of exclusivity, we will further negotiate with the preferred bidder to ensure their final offer is appropriately reflected in a formal Heads of Agreement.

Stage 6: Due diligence and completion

Following the signing of Heads of Agreement, we will assist throughout the period of exclusivity and the acquiror’s due diligence process. We help to interpret the implications of any due diligence findings and ensure that their commercial implications are appropriately dealt with in the final deal structure.

We also advise on the reasonableness of commercial clauses within the sale and purchase agreement and associated legal documentation.

Once this process is finished, a completion date will be set. This is when all parties will sign the final contract. Funds are exchanged and the business is transferred.

Below you can see the timeline of a ‘typical’ sale:

This communication is for general information only and is not intended to be individual advice. It represents our understanding of law and HM Revenue & Customs practice as at 17 May 2019. You are recommended to seek competent professional advice before taking any action. The value of investments and the income from them can go down as well as up, and you may get back less than you originally invested. Past performance is not a guide to the future. The investments described are not suitable for everyone. This content is not personalised investment advice, and Cooper Parry Wealth can take no responsibility for investment decisions you may make as a result of this information.

This communication is for general information only and is not intended to be individual advice. It represents our understanding of law and HM Revenue & Customs practice as at 14 August 19. You are recommended to seek competent professional advice before taking any action. The value of investments and the income from them can go down as well as up, and you may get back less than you originally invested. Past performance is not a guide to the future. The investments described are not suitable for everyone. This content is not personalised investment advice, and Cooper Parry Wealth can take no responsibility for investment decisions you may make as a result of this information. Tax and estate planning advice are not regulated by the FCA.

Send an email to us at iant@cooperparry.com