Mar 20, 2020 | JONATHAN ELSIGOOD

Published: 20th March 2020

At the moment, it’s hard to think about anything but the present. The past is the past, and the future feels so uncertain. But historic performance data can be really helpful when putting current market falls into context.

Emotions are running high. For those that have lived through previous stock market crashes, such as the financial crisis of 2007/08 it’s all too familiar. For younger investors who haven’t before experienced significant market falls it’s the fear of the unknown.

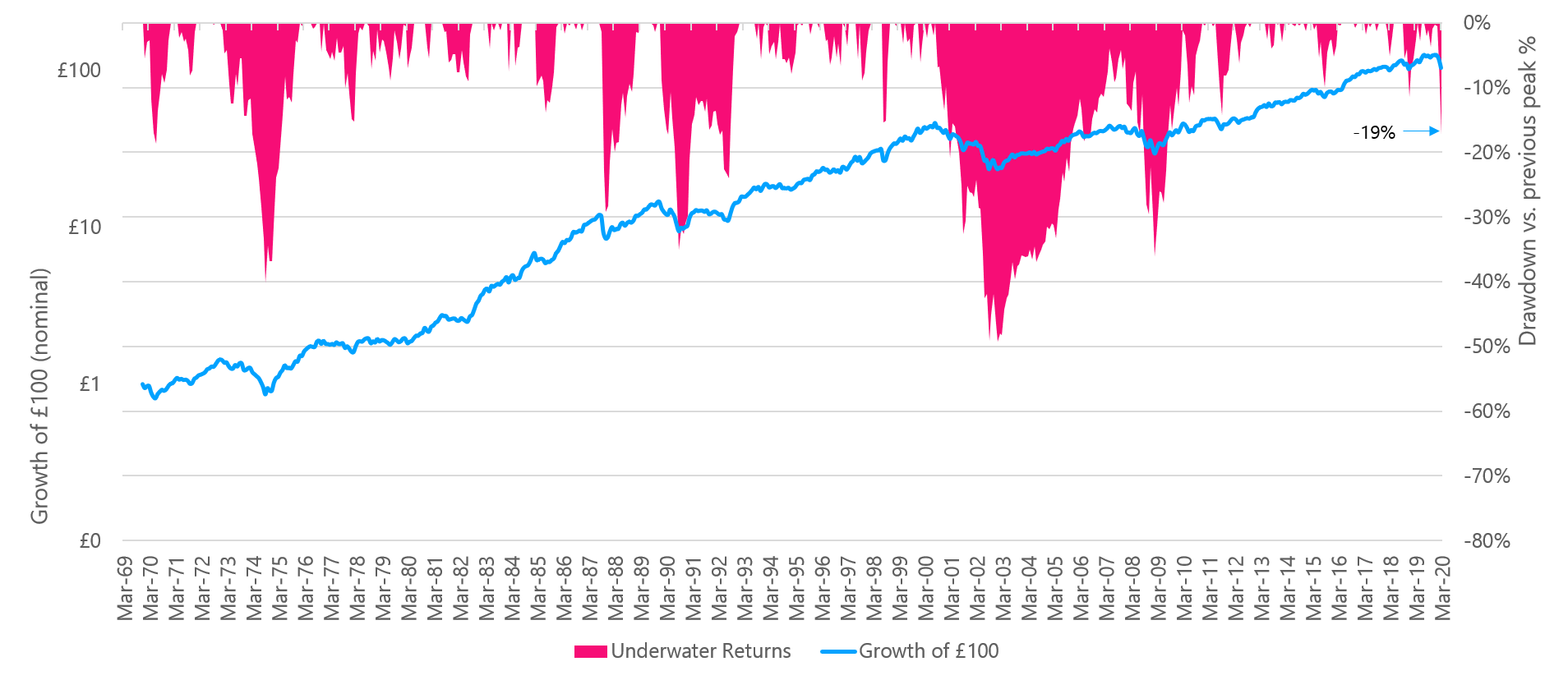

We obviously don’t have a crystal ball but the global equity market falls we’ve seen since January – just under 20% or so at the time of writing – sit well within previous market falls since 1970 – the five largest falls are shown in the graph below.

We generally estimate that 95% of the time, annual equity market returns should sit within an approximate range of +45% to -35%.

Figure 1: Today’s falls still sit well within both history and expectations (1/1/1969 to 18/03/20)

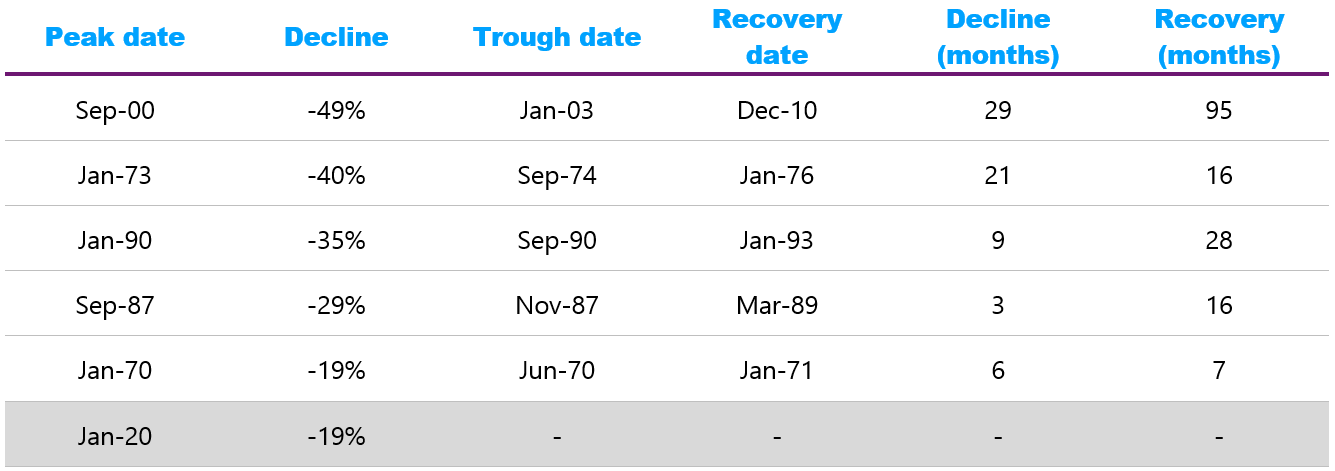

The table below shows numbers around both the depth and recovery times for each of the five largest falls since 1970 in the figure above.

Table 1: Declines and recoveries of global equity markets (1/1/1970 to 18/3/2020)

The recovery times also sit well within the investment time-frames of most investors. It’s also worth noting that an investor in global equities today has, in nominal terms, more money than they did at the end of March 2018, despite the market falls in late 2018 and those recently experienced.

How deep or long the current falls will be, no-one knows. There will certainly be more rises and falls to come. Yet we should take some comfort from the fact that things have been just as challenging at times in the past, albeit each time there have been very different reasons.

These are tough times for all of us and for our Nation, but the words of wisdom that we always return to, particularly at these times, are those of the legendary investor John Bogle:

‘This too shall pass’.

It absolutely will.

From an investment perspective the key message is to be brave and disciplined. A market fall only becomes a loss if you sell. Remember, we are always available to take your call or answer your emails. Please feel free to contact us if you have any specific questions or simply if you would like some reassurance.

Past performance can’t guarantee what investments will do in the future. The value of a portfolio can go down as well as up, so there’s a chance you’d get back less than you put in.