Being an investor is emotionally challenging. Even after a run of positive years, it’s entirely natural to worry that some of the gains may be given back. This is regularly a feature of a long-term investor’s journey; two steps forward, one step back and so forth.

As the calendar turns, it’s once again the silly season of bold market predictions for the year ahead. Experience suggests such forecasts are best treated lightly. The future, by definition, is unpredictable. Our sensible forecast for the year ahead remains unchanged: markets will go up, down and sideways.

Looking backwards

The past 12 months provided another reminder of how quickly assumptions can be challenged and narratives rewritten.

Politically, 2025 was a year of striking upheaval. A new US administration set about reshaping domestic policy and foreign relations with remarkable speed and ambition. Trade policy proved a powerful source of stock market volatility. Announcements of sweeping tariffs triggered sharp and sudden market reactions in April, only for many of those measures to be softened, delayed or diluted as practical realities intervened. Markets, as they often do, adjusted quickly to both the shock and the subsequent recovery over the following few months.

Artificial intelligence dominated headlines throughout the year. Vast sums were committed to AI infrastructure, chip manufacturing and model development, fuelling talk of a new industrial revolution. Company valuations reached eye‑watering levels and, for a time, optimism seemed boundless. Yet confidence, at times, proved fragile. The emergence of cheaper and more efficient AI models and underlying technology raised uncomfortable questions about competitive advantage and whether all the investment will ultimately translate into profits. This competition is a natural part of a capitalist world and embedded in the risk and expected rewards of stock ownership.

Beyond markets and technology, the world remained unsettled. A fragile ceasefire in Gaza held for much of the latter part of the year, offering some respite but little in the way of lasting resolution. The war in Ukraine continued, grinding on with terrible human cost and little decisive movement. Elsewhere, conflict intensified in parts of Africa, while tensions escalated across parts of Asia. Natural disasters added further strain, with devastating earthquakes, wildfires, and extreme weather events affecting millions.

And yet, despite all this, the global economy proved more resilient than many had feared. Growth endured, employment held up better than expected, and some central banks were able to begin cautiously lowering interest rates. Markets, overall, delivered another reminder that they are forward‑looking, adaptive and often more robust than the prevailing mood suggests.

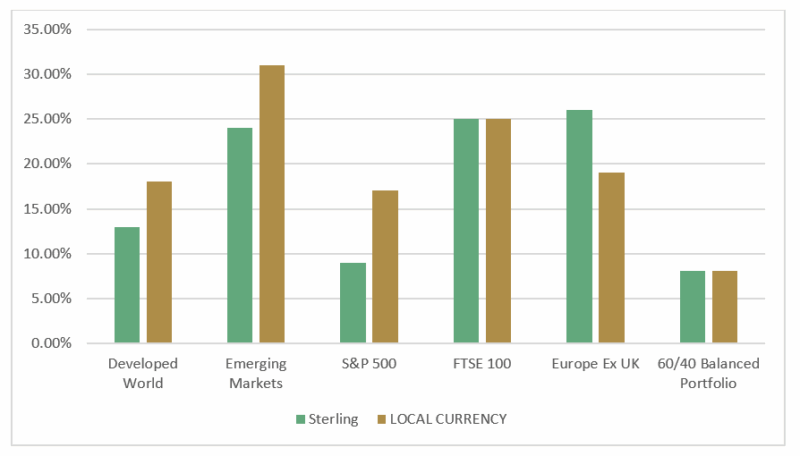

Below is a summary of global stock market total returns in sterling and local currency terms. Most notably 2025 saw the US market underperform other international markets whilst emerging markets had their best year for around 10 years. The weaker US dollar, largely a response to the actions of the new US government, proved a headwind for sterling investors. But even so, positive healthy returns were returned across the globe. And this all despite the 10% market falls we witnessed in April, the immediate response by markets to the new US trade tariffs.

Source: Financial Analytics. Percentages shown are for illustration only and reflect past performance, which is not a reliable indicator of future results.

For diversified investors, 2025 reinforced some long‑standing lessons. Despite the market volatility and global uncertainties, a traditional 60/40 balanced portfolio (60% global equities and 40% global government bonds) delivered a healthy return with a somewhat smoother investment journey. Long term investment success continues to lie in owning a broadly diversified and well-structured, evidenced-based investment portfolio.

Looking forwards

Entering 2026, uncertainty remains abundant.

Interest rates are generally lower than they were a year ago, but their future path is far from assured. Inflation has eased from post Covid highs but looks to remain sticky. Trade tensions, elections and geopolitical risks are ever‑present. None of this is new.

What is sometimes forgotten is that today’s prices already reflect today’s fears, hopes and expectations. Markets do not wait for events to happen; they move in anticipation of them. What will most likely matter in the year ahead are the surprises, not the scenarios that dominate current debate and media headlines.

Trying to position a portfolio for specific outcomes requires a belief that one can consistently outguess the collective wisdom of millions of other participants. The evidence suggests that very few can do this reliably, including the professional fund managers.

Acting on strong convictions about the near‑term direction of markets may feel comforting, but it carries the risk of being wrong twice: once when exiting, and again when deciding when to reinvest.

Much has also been written about whether the world is currently in an AI ‘bubble’. Some argue that valuations are detached from reality and that a reckoning is inevitable. Others insist that the technology will justify current prices and more. Both views may ultimately prove right in different ways, and at different times.

In one view of markets, prices always reflect all known information, and what looks like excess is simply the rational pricing of uncertain future cash flows. In another, human behaviour and sentiment periodically push prices too far in either direction. In practice, these are just models, not truths.

The uncomfortable reality is that only with hindsight will we know whether the World is currently living through an AI bubble. By then, it will be too late to act on that knowledge.

New year. Same Mantra

Market outcomes will be shaped by events that cannot be predicted with confidence. Against this backdrop, the most robust response remains unchanged: maintain broad diversification, stay invested and continue to stay focused on your long‑term goals, rather than short‑term media noise.

Your Relationship Manager is here to advise and help you; please reach out and contact them with any questions.

Past performance can’t guarantee what investments will do in the future. The value of a portfolio can go down as well as up, so there’s a chance you’d get back less than you put in. Changes in exchange rates could affect the value of overseas investments and the effect of inflation could reduce the future purchasing power of your investments.

This communication is for general information only and is not personalised investment advice. It does not take account of your objectives, needs or circumstances.

Any forward-looking statements in this document reflect opinion, not certainty, and are not a projection or forecast of future performance.