In January we launched a new series Unpacking Pensions: April 2027 & Beyond, exploring the impact of the government’s announcement that pensions will be included in estates for Inheritance Tax (IHT) from April 2027.

As we progress towards April 2027 many clients have already been asking us: Are pensions still a good place to save for retirement—and beyond?

For most people, the answer remains a resounding yes.

Pensions continue to be the most tax-efficient retirement savings vehicle available. Even for those who may not need their pension savings during their lifetime – and are instead focused on passing them on to children or grandchildren – pensions can still offer advantages, even after the proposed changes in 2027.

First, let’s revisit a long running debate – are pensions or ISAs best – because if you don’t invest more money in your pension, ISAs are the next best option.

Pensions vs ISAs

Both pensions and ISAs offer tax-free growth, protected from Income Tax and Capital Gains Tax (CGT). However, they differ in when the tax advantage is applied:

- Pensions: Contributions receive upfront Income Tax relief, but withdrawals (beyond the tax-free lump sum) are taxed as income. No CGT payable on pensions.

- ISAs: Contributions are made from post-tax income, but withdrawals are entirely tax free.

The upfront Income Tax relief available on pensions is often a powerful advantage. Unless you expect to pay a higher rate of Income Tax in retirement than you do while working, pensions typically come out ahead.

Example:

Jim is age 58, a 40% tax payer, with one daughter, Anna. His wife, Jean, died a few years ago.

Pension: Jim makes a gross pension contribution of £16,667, which only costs him £10,000, due to the tax relief received.

To keep things simple, let’s assume no investment growth.

If Jim continues to be a 40% taxpayer, he could later withdraw that same £16,667 from his pension:

- 25% of it, £4,167, as tax-free cash, and

- £7,500 (£12,500 gross, net of 40% Income Tax) as income

- = £11,667 net, in his pocket

ISA: Jim’s £10,000 ISA investment, again with no investment growth, remains at £10,000 and can be withdrawn tax-free.

In this example, the pension delivers a better outcome for Jim, an extra £1,667 (+ 16.7%).

Other taxable investment accounts: if Jim’s ISA allowance is already utilised, then the advantage of a pension investment compared to investment in a fully taxable account (subject to Income Tax and Capital Gains Tax) is even greater.

What About on Death?

Death and taxes remain life’s two certainties. From April 2027, undrawn pension funds will be subject to a 40% IHT charge—the same as ISAs.

However, pensions face particular scrutiny for those who die after age 75 – their pension could be taxed twice:

- 40% IHT on the undrawn pension fund; then

- Income Tax at the beneficiary’s marginal rate when the net funds are withdrawn.

This potential double tax charge – reaching as high as 67% – has attracted significant media attention, raising questions about the long-term value of pensions.

Yet, the real-world impact will depend on individual circumstances. For many, pensions may still perform at least as well as, if not better than, other alternatives such as ISAs and taxable investment accounts.

Continuing our example:

So Jim, our 40% taxpayer, has contributed £16,667 to his pension (costing him £10,000 net). If this is left untouched, we assume no investment growth and Jim dies post-75, leaving his pension to his daughter, Anna:

- 40% IHT reduces the pot to £10,000.

- If Anna pays Income Tax at 20% she would receive £8,000 after tax.

By contrast, the £10,000 Jim paid into an ISA would become £6,000 for Anna after IHT.

Even in this less favourable scenario, the pension still provides an extra £2,000 (+ 33%) compared to the ISA for Anna.

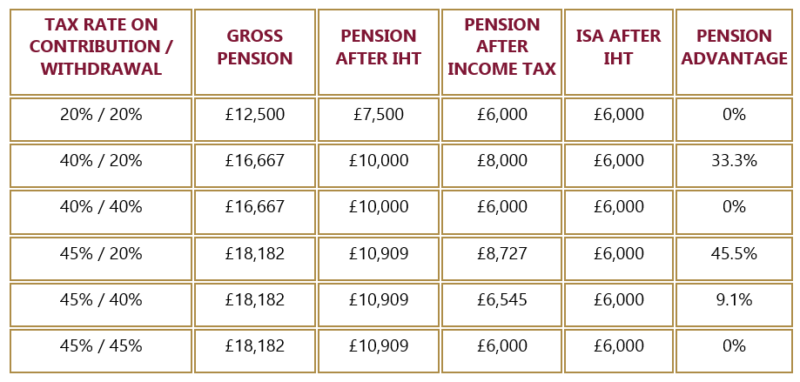

If Anna is a 40% taxpayer, the outcome of the pension investment and ISA investment are the same, a neutral outcome. A similar result is achieved if Jim’s pension contributions had received 45% income tax relief and Anna pays 45% Income Tax on the net funds received. The table below shows further comparisons:

The pension advantage assumes no further tax planning before death. We expect many clients will wish to explore trading a 45% Income Tax charge by drawing on unspent pension funds during lifetime and gifting surplus income, thereby avoiding a higher effective tax rate on death.

This type of planning needs to be explored as part of an overall estate planning strategy, but it shouldn’t distract from the use of pensions as an effective vehicle for wealth accumulation.

What If You Die Before 75?

If Jim were to die before age 75, and leave his pension to Anna the benefits, even after April 2027, remain even more attractive.

There’s no Income Tax payable by Anna on pension withdrawals from the pot she inherits from her father (unless the value exceeds the Lump Sum and Death Benefits Allowance).

In many modern pension schemes, beneficiaries can use Beneficiary Drawdown, giving them control over how and when to access funds—and how much tax they’ll pay.

Knowing the death benefit options available within your pension is essential for effective legacy planning and your Relationship Manager can help you with this.

The Bigger Picture

The introduction of IHT on pensions from 2027 certainly changes the landscape, creating more parity with ISAs and other savings options. While the possibility of a double tax charge exists, pensions can still deliver better outcomes than alternative investments in many cases – especially with careful financial planning.

Ultimately, a well-structured retirement and legacy plan – balancing pension withdrawals, other savings, and tax considerations – will be key to making the most of your assets, both during your lifetime and beyond.

Speak with your Relationship Manager or contact us at theteam@cooperparry.com to explore the actions you should be considering.

This communication is for general information only and is not intended to be individual advice. You are recommended to seek competent professional advice before taking any action. The information is based on our understanding of the Autumn Budget 2024 and will be affected by changes in law as well as your residency and domicile status.

Past performance can’t guarantee what investments will do in the future. The value of a portfolio can go down as well as up, so there’s a chance you’d get back less than you put in.