Given the turmoil currently surrounding the revolving doors at No 10 and No 11 Downing Street, it’s no surprise that investors are feeling unsettled. None of which is helped by the endless media frenzy – here and globally.

Talk of market failure risk by the Bank of England, squabbling politicians and headline grabbing market traders and analysts will all add to the sense of doom and gloom. A few months ago, the news focussed on some of the dramatic falls in value of US tech stocks like Meta. Today, it’s all about inflation and bond yield rises.

If you’re having to refinance a large mortgage at, say 6% instead of 2%, that might well hurt. But if you’re an asset owner, being able to generate a yield of 4% on your short-term bonds going forward isn’t so bad. It’s much better than the miserly near-zero yields of a year or so ago. It’s easy to get sucked in by the constant speculation. But resist. Or you risk missing the wood for the trees.

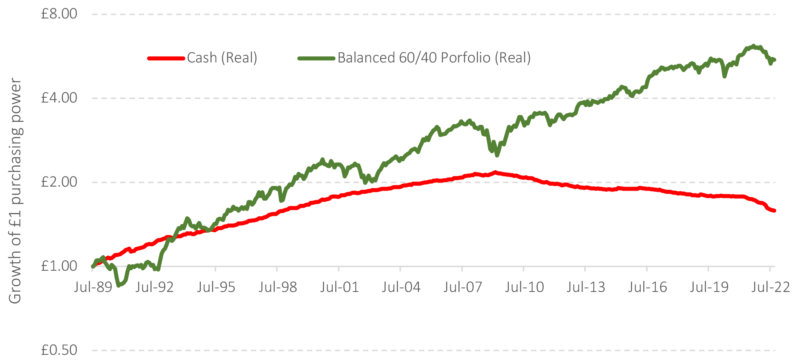

So, let’s head back to calmer waters and take a look at the ‘boring’ 60/40, equity/bond portfolio. It provides a sensible balance between the upside, real (after inflation) return expectations from equities and the downside balancing exposure to higher-quality, shorter-dated bonds for longer-term investors[1]. The numbers below illustrate clearly that it has done a pretty good job since 1989 of helping investors grow the purchasing power of their assets. Cash is provided for comparison.

Figure 1: The ‘boring’ 60/40 portfolio – July 1989 to September 2022

Source: Albion Strategic Consulting modal portfolio. Data from Morningstar Direct © All rights reserved[2].

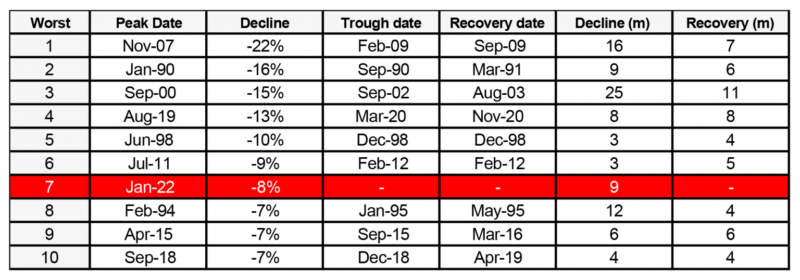

In the past ten years, up to the end of September 2022, investors would have achieved a more than 55% rise in their purchasing power. In 2022 such a strategy is down -8% before inflation and -16% after inflation. Although this is disappointing, it sits well within the bounds of expectation for a portfolio like this. As the data in the tables below show.

Table 1: Tops ten falls and recoveries since July 1989 – before inflation

Source: Albion Strategic Consulting modal portfolio. Data from Morningstar Direct © All rights reserved (as per Figure 1)

Ten tips for avoiding stormy waters

At times like these, there are a number of things that investors can do to feel calmer and more in control:

- Read, watch or listen to less financial press and commentary.

- Accept that investing is always a two steps forwards, one step back journey.

- Try not to dissect your portfolio statement line by line – look at the big picture.

- Look at portfolio outcomes over the longest time frame you have available.

- Remember that a fall in value is not a loss unless you sell.

- Higher bond yields and lower equity prices point towards higher expected returns.

- Attempting to jump in and out of markets is simply guesswork, and likely to be costly.

- Place 2022 in the context of your multi-year, or even multi-decade, investment horizon.

- Keep your eyes on the prize of building future purchasing power over the longer term.

- Keep the faith – stay invested.

- And a sneaky 11. Talk to us. We’re here if you want to review your investments. Talk through your long-term financial plans and plan for the future.

Risk warnings

This article is distributed for educational purposes and should not be considered investment advice or an offer of any security for sale. This article contains the opinions of the author but not necessarily the Firm and does not represent a recommendation of any particular security, strategy, or investment product. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.

[1] The appropriate balance between bonds and equities for an investor can only be arrived at through a deep discussion between client and adviser. This analysis has been provided for educational purposes only.

[2] Diversified portfolio of global developed and emerging market equities tilted to value and smaller companies with a small allocation to global commercial property balanced with short-dated high-quality bonds and a small allocation to index linked gilts. Index data to 12/2021 and live fund data thereafter. Full details available on request. Estimated current OCF costs deducted for all periods. Inflation – UK CPI. Cash – UK 1month T-bills to 2021 and SONIA for 2022.