Nov 9, 2018 | EWAN ROSIE

In life we often hear the phrase ‘you get what you pay for’ and usually it’s a fair assumption to make when you are buying a product or service. However, in the investment world, this couldn’t be further from the truth.

To add to the confusion, our industry has been very poor at fully disclosing the costs of investing, with much of the true information hidden in the small print, or even worse, not being disclosed at all! Even when costs are discussed, they’re often difficult to understand, using terms or abbreviations such as AMC (annual management charge), TER (total expense ratio) and PTC (portfolio turnover cost). It’s a lot to understand alongside dealing costs, dilution levies, stamp duty and performance fees and exit penalties to name a few more! To be clear, some of these things aren’t applicable to Cooper Parry Wealth but we think you can see how easy it is to get confused very quickly.

For a typical active fund manager, these costs can be in the region of 2-2.5% p.a. when you factor in all the various charges and this may not even include advice.

The importance of transparency

At Cooper Parry Wealth, we’re committed to being fully transparent about our costs and thankfully there’s a new regulation called ‘MIFIID II’ that requires investment providers to be more transparent by law. However, as expected many investment fund managers are scared of presenting the true costs of their investments; Money Marketing (8/10/2018) reported that the FCA are already investigating 34 fund managers about potential breaches of the new regulation.

This is so important because full disclosure about costs will enable investors to make more informed decisions about the investments they make and what sort of advice, if any, they will receive separately. Remember, investment costs are different to advice costs as they have separate purposes but are often confused or packaged together.

Another reason that this is so important is that all the evidence points to lower investment costs providing higher returns. Many investment managers and even some financial advisers, will try to argue that the importance of fees and charges has been exaggerated. It’s not about cost, they argue, but the value that a product provides. The evidence shows however, that many financial products are effectively priced to fail. In other words, any market outperformance they provide is outweighed by the higher costs of using them.

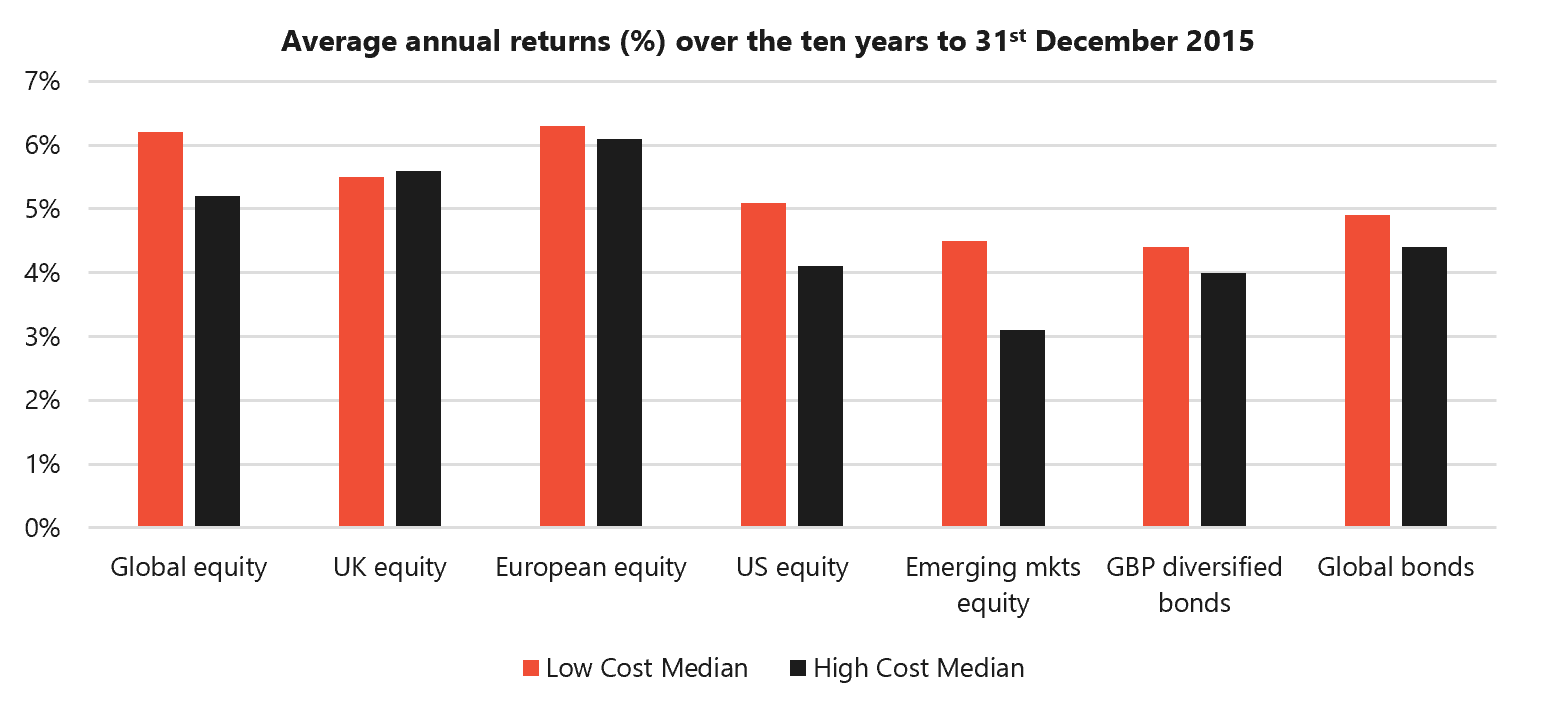

Investment costs have been analysed heavily over the years by Vanguard and when you look across the investment spectrum, low cost investment funds have outperformed high cost investment funds, as highlighted in the below chart.

Source: Vanguard Principle of Successful Investing

Sometimes investors don’t pay enough attention to these cost differences as they may not realise how much impact a small % difference can have when compounded over a longer period of time.

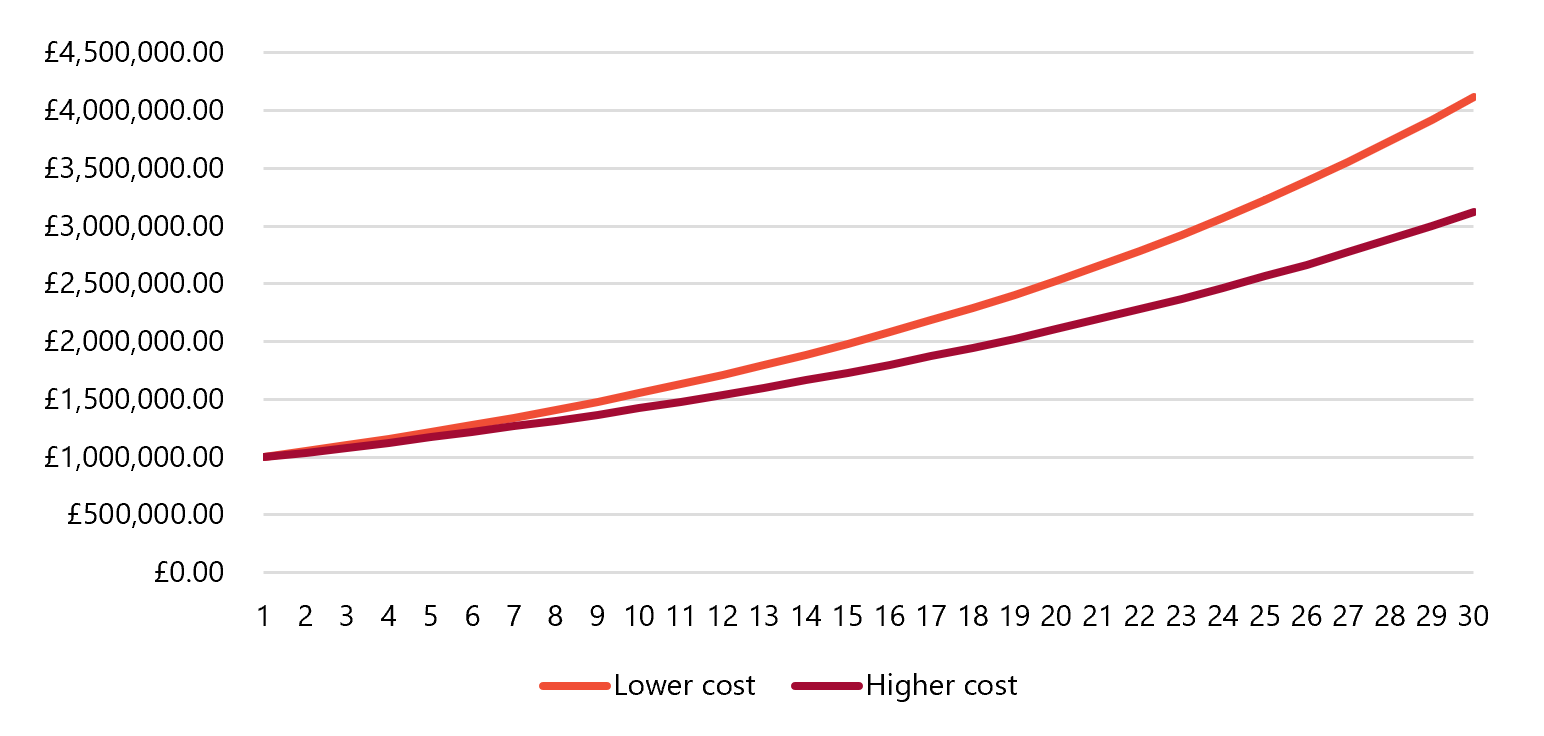

The following chart shows the difference 1% in charges can make over the longer term, using a 4% and 5% growth rate on an initial investment of £1,000,000.

Over 30 years, the difference is approximately £1,000,000, which would have been paid to a fund manager, instead of landing in the investors back pocket!

You might be getting to this point and wondering about the costs and benefits of using a financial planner. Research[1]by Vanguard highlights five keys ways financial planners help investors. These are:

1.Selecting a suitable investment portfolio – well diversified, sensible risk profile and rebalanced regularly.

2.Having appropriate investment costs – ensuring investors receive more of the returns.

3.Tax efficiency – ensuring tax allowances are used and that drawdown decisions don’t prove costly with regards to income tax, capital gains tax and inheritance tax.

4.Spending strategy and withdrawal order – understanding how best to deliver the income and capital you need to live life.

5.Behavioural coaching – keeping an investor on track and coaching them not to react emotionally.

The last of the five was highlighted as the most valuable. Why? Because it’s extremely important to remain invested over the longer term and understand how important it is to stay disciplined over time – particularly during times of uncertainty. That’s when many people take the wrong course of action. Behavioural pitfalls such as trying to time the markets or chasing performance are among the biggest mistakes. But without an adviser, how would you know this and how would you know when to remain disciplined and when to make a change?

At Cooper Parry Wealth we remain committed to keeping our investment costs low and this is something we assess every year when completing our fund audit and our Wrap platform review. If you want to understand our costs in more detail please get in touch.

The value of investments and the income from them can go down as well as up, and you may get back less than you originally invested. Past performance is not a guide to the future. The investments described are not suitable for everyone. This content is not personalised investment advice, and Cooper Parry Wealth can take no responsibility for investment decisions you may make as a result of this information.

Send an email to us at iant@cooperparry.com