Feb 22, 2021 | SARAH LORD

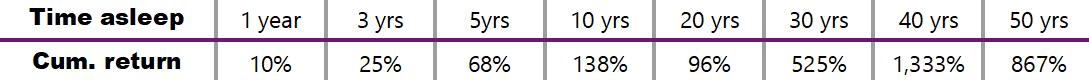

If Sleeping Beauty had woken from her slumbers on New Year’s Day 2021, she would’ve been blissfully unaware of the global pandemic and the market turmoil COVID subsequently caused in the spring of 2020. Awaking to some cumulative market returns that aren’t to be ignored…

Cumulative returns, after inflation to 30 Dec 2020

As investors, we should take a similar approach when it comes to our assets, reminding ourselves that time and the compounding of returns are our friends. By no means should you be asleep at the wheel but taking a hands-off approach has its benefits.

Understandably, many investors still feel nervous about the future. But the world keeps on turning and moving in a positive direction.

Let’s turn our attention to some of those feel good insights…

The vaccine – The scientific community has done a remarkable job delivering the world with a suite of vaccines that provide a way out of the pandemic. The UK has played a leading role, not only in vaccine development, but also identifying existing drugs that are, and will, have a major impact on treating patients. There’s light at the end of the tunnel.

Learning lessons – We’ve learned many valuable lessons and built resilient processes and a logistics infrastructure for coping with any future pandemics – as a country and as individuals. This has to be a good thing! 2020 reminded us how much we need each other and what a powerful sense of community feels like. We will come out of this better prepared and hopefully more appreciative of the things we value such as family, friends, a round of golf, or a drink at the pub! A fresh enthusiasm for truly making life count!

Coming together and building trust – With the inauguration of Biden as President in the US at the beginning of the year, perhaps we’ll see a calmer, more inclusive approach to politics, a greater emphasis on the truth and the rebuilding of trust between democratic friends and allies that will help the free world to resolve some of the major issues we face.

Change for good – Talking of US presidents, it feels like we might’ve reached a tipping point when it comes to social media, where something needs to change. The lines have often been blurred between free speech and hate speech, fact or fiction and technology or trusted publication. It’s clear that these platforms can be used for positive change and that this needs to be harnessed to instil truth and trust.

Taking care of the world – Finally, there appears to be an ever-increasing urgency to address climate change, with the UK at the forefront, not least with the presidency of the UN Climate Change Conference in Glasgow later this year, and the government’s pledge to reduce carbon emissions by 68% of its 1990 levels by 2030. In the past 10 years, the UK has made more reductions than any similarly developed country. It’s also set a target for net-zero emissions by 2050 and pledged to ban the sale of new petrol and diesel cars by 2030. With the US re-engaging, the momentum is shifting toward greater action, which also encompasses green finance and more sustainable investing.

Does all this mean that markets will rise in 2021? The truthful answer is that no-one knows. But if we take a leaf out of Sleeping Beauty’s book, there is a pretty reasonable chance that the world will be in a better place in the not-too-distant future. So, remember to keep your cool in the face of unnerving change, remind yourself of the positives that are all around us and take the time to rest if you can.

When we look back on this time, we will undoubtedly remember the resilience, innovation and dynamism of the world.

If you’d like to chat, get in touch with your usual contact or book a free, no obligation chat with Ian, our Business Development Manager, by clicking here.

Past performance can’t guarantee what investments will do in the future. The value of a portfolio can go down as well as up, so there’s a chance you’d get back less than you put in.