May 18, 2021 | JONATHAN ELSIGOOD

We love a five-star rating these days! Five stars means something is the best, top of the game or the most luxurious. And we’re all familiar with checking platforms such as Google or Trustpilot to see reviews about services and products that we might choose to use.

Five star investment funds exist

Or at least the internet says they do.

Lots of institutions offer their own spin on star ratings and how to calculate them.

But unlike the hotel industry, many of the rating systems that assess investment funds used by investors are best ignored.

A quick Google of a fund name will most likely return links to some of the major data providers out there such as Trustnet, Morningstar, and The Financial Times.

It’s here you’ll find star ratings, or something similar, that imply the quality of a fund.

The screenshot below shows an example of a UK equity fund that’s currently rated as ‘5 Crowns’ on Trustnet. This is not a recommendation from us, just an example so you see what we mean…

What’s the problem with rating funds?

The ratings focus on recent, short-term performance as opposed to long-term, sensible structure.

Without getting too granular, the Crown Ratings derived using 3-year performance and volatility – how much the performance moves up and down – compared to a benchmark, such as the FTSE 100 Index.

The problem is that 3-years is not nearly enough time to properly measure the success of an investment fund nor for that matter, the success of an investment portfolio as a whole.

To put that into context, financial economists who study fund manager performance tell us that you need nearer 20 years of performance history to be able to distinguish luck from skill in a fund manager’s decisions.

That in turn raises to added problems – firstly, you need to identify the skilful managers in advance (not ex post as you wont benefit from their past performance), and secondly, the average tenure of a UK fund manager is considerably less than 20 years!

Structuring portfolios based on ratings is a dangerous game

Sadly, there are many investors out there who do pay attention to these ratings and are engaged in a repetitive cycle of buying-high and selling-low.

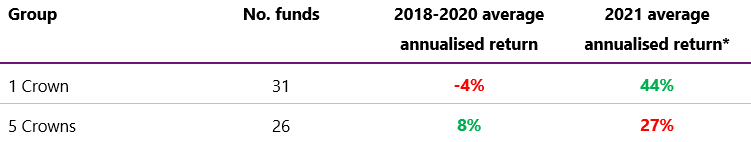

To demonstrate, we looked at the ‘1 Crown’ and ‘5 Crown’ UK equity funds, whose ratings were last updated in January 2021. The 1 Crown funds that performed poorly during the years where the ratings were calculated, have materially outperformed the 5 Crown funds on average so far this year.

UK equity fund performance of 1 Crown and 5 Crowns funds

This goes to show that just because something has done well recently doesn’t mean it will continue to do so.

Our approach to investing accepts that markets work well and that beating them is extremely difficult without the benefit of hindsight.

It’s wise to make sure your portfolio is structured to capture sensible market risks over time, through broad diversification across countries, sectors and companies whilst keeping costs as low as possible.

Based on the evidence – we call that a 5-star solution!

Past performance can’t guarantee what investments will do in the future. The value of a portfolio can go down as well as up, so there’s a chance you’d get back less than you put in. This communication is for general information only and is not intended to be individual advice. You are recommended to seek competent professional advice before taking any action.