Mar 1, 2018 | EWAN ROSIE

You might already be familiar with PortfolioScience™, our evidence based investment approach. It’s built around these six principles of successful investing:

1.Accept the stock market is tough to beat

2.Understand risk and return are related

3.Don’t put all your eggs in one basket

4.Focus on the investment mix (between growth and defensive assets)

5.Keep your costs low

6.Control your emotions and think long-term

Over the coming months we’ll be blogging on each of these subjects in more detail, and here’s the first instalment.

Accept the stock market is tough to beat

Generally, there are two investment strategies that investors (and investment professionals) can choose from:

1.Active management – where you make stock or fund selections and/or attempt to ‘time’ the market, to outperform a benchmark index. E.g. you pick a number of UK shares because you think they’ll outperform the FTSE 100, or ‘beat the market’.

2.Passive management – sometimes referred to as ‘index tracking’, this involves buying shares in all of the companies within a specific index and holding them for the long term. E.g. buying the 100 companies within the FTSE 100, through an index tracking fund.

Our Investment Committee regularly reviews the methodology we use to build our model portfolios. Each year we look at new pieces of evidence, as well as academic studies.

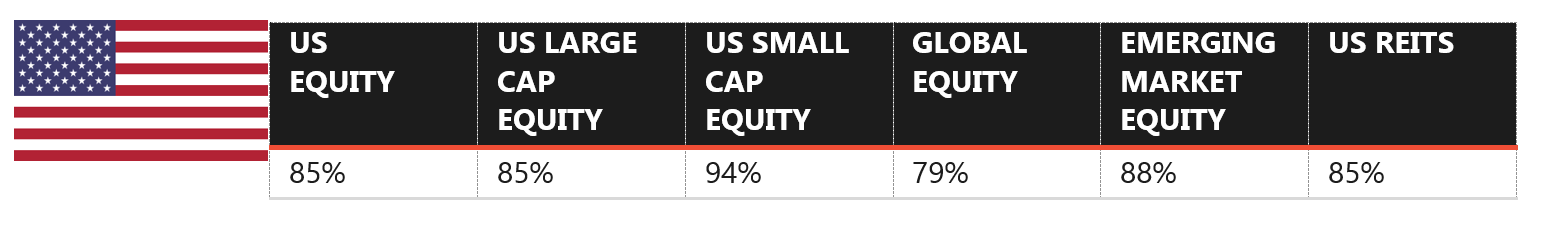

One of these studies is the SPIVA (Standard & Poors Indices Versus Actives) scorecard. It looks at how many investment funds from the UK and USA failed to beat their benchmarks over a ten year period.

Here are the ten year results to mid 2017 (the year end figures haven’t been released yet).

As you can see, most funds don’t outperform their benchmark and this has been a consistent historical message as the study is updated twice a year.

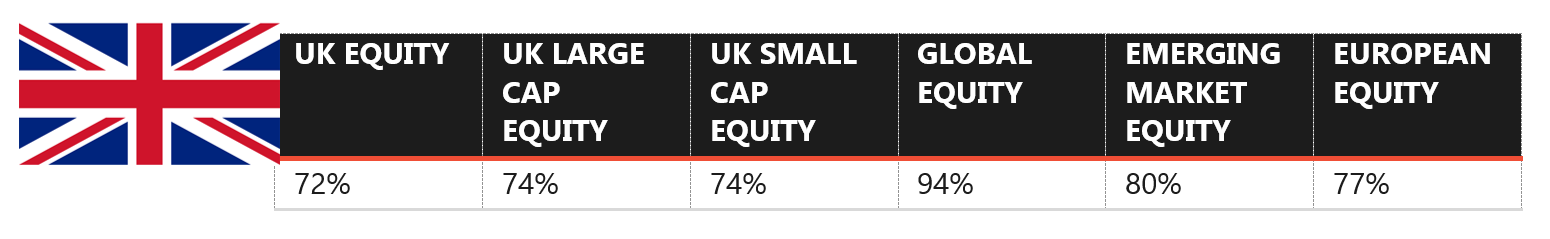

Vanguard also produce some research into whether the top performing funds from one five year period, maintain their performance over the next five years. The study ranks the returns of UK equity funds for the five years to the end of 2011. The funds are divided into quintiles, separating out the top 20% and then the next performing 20% etc.

Vanguard then tracked the funds’ performance over the next 5 years, through to December 2016. If the funds in the top quintile were consistently performing, we’d expect them to remain in the top 20%.

The table shows that whilst around a quarter of the top funds retained their position, the same funds stood a much larger (39%) chance of falling into the bottom two quintiles, or even closing. Similar reach is regularly run by Standard & Poors on US investment funds and reaches the same conclusion.

Overall, these studies continue to show that most funds fail to beat their benchmarks over the longer term. And any that do have short term success find it very difficult to repeat year on year.

Orlando the stock picking cat!

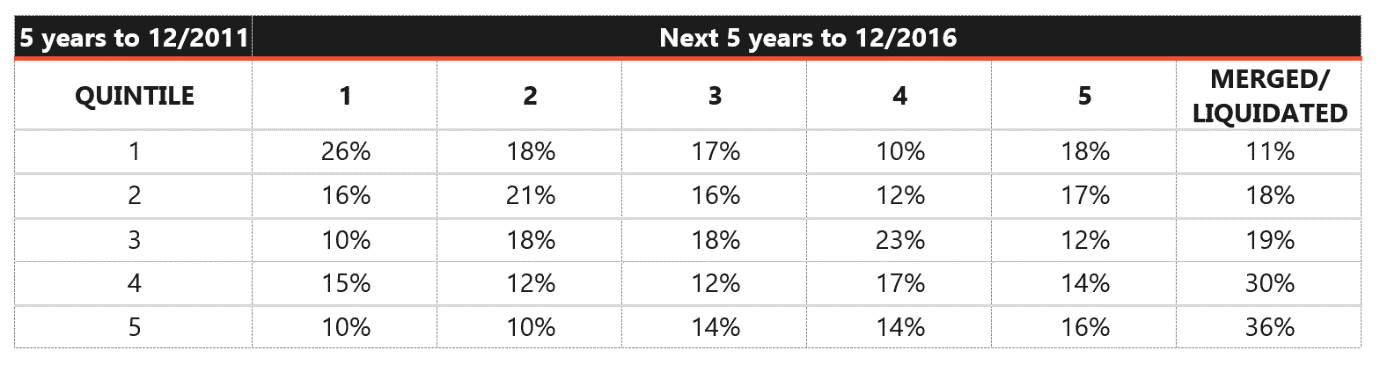

Back in 2012, The Observer newspaper set up a challenge. They pitted professionals from three well known investment managers against students from a Hertfordshire School and a cat, called Orlando.

Each team had a notional £5,000 to invest in five companies from the FTSE All Share Index at the start of the year. Every three months, they were allowed to make any trades they wanted, so long as they continued to hold five stocks.

Whilst the investment professionals used their ‘vast experience’ and ‘traditional stock picking methods’, the students based their decisions on what they’d been learning about in school. Orlando’s technique was to throw his favourite toy mouse on a grid of numbers allocated to different companies.

The challenge raised the question as to whether the professionals could beat the students and Orlando by using their ‘experience and knowledge’ to show their skill.

So, guess who won?

That’s right, embarrassingly a cat beat the professionals! This graph shows the end value of each team’s initial £5,000.

And no one actually beat the market.

Though we’d never advocate basing any investment beliefs on such a short period of time, the study does highlight some of the factors that make active investment management so difficult; short termism, needless trading and the resulting costs, emotional decision making and minimal diversification.

There are two economic theories that back us up too:

Random Walk Hypothesis – popularised by Burton Malkiel in his book “A Random Walk Down Wall Street”. He explores the idea that share prices move completely at random, making specific stock selection entirely unpredictable.

Efficient Market Hypothesis – this Nobel Prize winning theory by Eugene Fama stated it’s impossible to beat the market. Markets are deemed to be ‘efficient’ because all known information about any company is factored into a share price. Because stocks trade at their fair price, it makes it impossible for investors to purchase shares at undervalued prices or sell at inflated prices.

Ultimately, no one can predict the future. Based on the academic evidence available, we continue to believe that passive, or index tracking funds give our clients the best chance of investment success in the future.

Look out for a blog on our second principle ‘risk and return are related’ in the next few weeks, but if you’ve got any questions, just get in touch.

References:

SPIVA US Scorecard

Vanguard – The case for low-cost index-fund investing

The value of investments and the income from them can go down as well as up, and you may get back less than you originally invested. Past performance is not a guide to the future. The investments described are not suitable for everyone. This content is not personalised investment advice, and Cooper Parry Wealth can take no responsibility for investment decisions you may make as a result of this information.

Send an email to us at iant@cooperparry.com