Oct 17, 2022 | JONATHAN ELSIGOOD

A week’s a long time in politics. For those trying to make meaningful business decisions, you better believe it.

Just over three weeks on from setting a new course for growth, the government has backtracked on pretty much everything in the Mini Budget.

“Dear, Oh Dear” as King Charles was heard to say to Liz Truss.

Jeremy Hunt, our fourth Chancellor since July, stated that “we will reverse almost all the tax measures.” In fact, a total of £32 billion of tax changes have been reversed. This unprecedented trashing of government policy is designed to offer market stability. And set a new course. Only time will tell.

A more detailed statement is expected soon, but this is what’s being scrapped and what’s being kept (for now).

SCRAPPED:

RETAINED:

Watch this space for the next twists and turns.

27 September 2022 Update.

On Friday, the Chancellor Kwasi Kwarteng unveiled a £45bn tax cut package, that has not been met positively in markets. We saw government bond (Gilts) yields increase (which leads to corresponding price falls as the locked in interest rates become unattractive), sterling devalued, and the FTSE 100 Index took a tumble. However, the FTSE 100s performance was in line with wider global stock market performance and Gilt yields have been volatile since interest rates started rising to combat inflation, earlier in the year

The weakening of the pound has captured the headlines given that at one point, a new record low against the US Dollar was set, although the exchange rate has recovered a little as at the time of writing. Market traders are stating their opinion that the UK economy is weak.

In tandem, gilt prices have fallen further and continue to be volatile, by historic standards, with the Bank of England again looking at further interest rate increases to try and shore up the weak pound.

It’s fair to say that the gilt and bond performance has been extreme over this period in the context of history. Many investors are therefore questioning their continued inclusion within investment portfolio.

Morningstar recently addressed this question and provided the following useful insight:

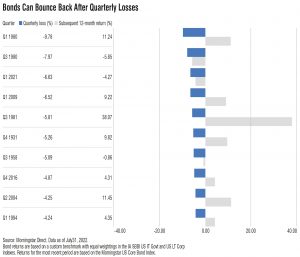

Morningstar looked at the 10 worst quarters for a custom US bond benchmark (the US being the biggest bond market in the world, and the largest allocation in our portfolios) going back to 1926. As shown in the table below, returns for the subsequent 12-month period were positive for 7/10 periods. However, it’s worth noting that that the 12-month period into 2022 was not one of those positive periods.

While bond returns can take a while to recover, history tells us that the future may not be as gloomy as investors fear. Additionally, if you have new funds to invest, it’s almost certainly a better time to invest in bonds now in comparison to previous times given the higher yields on bonds due to higher interest rates.

There may still be tough times ahead for bond markets and even though the diversification protection against equities may have diminished during this short time period, it’s still an important concept in a long-term investment portfolio. This is a unique period where a combination of economic events have all come together at once. We have high government spending, supply chain issues, high consumer demands, high oil and energy prices, the war in Ukraine, and currency issues, all of which are contributing to inflation and uncertainty.

This is where perspective becomes vitally important. Bond markets won’t always be this bad, and as central banks begin to get a handle on inflation, things should begin to settle.

Remember, that within our portfolios, we mainly hold short dated high quality bonds that haven’t suffered the larger losses that longer dated bonds and bonds with poorer credit ratings have seen, and will likely continue to provide an effective diversifier to stock markets in the future.

The message from us is keep calm, stick to your plan, and only consider any changes if your circumstances or objectives have changed.

Past performance can’t guarantee what investments will do in the future. The value of a portfolio can go down as well as up, so there’s a chance you’d get back less than you put in.

Send an email to us at theteam@cooperparry.com