Apr 3, 2020 | JONATHAN ELSIGOOD

Published: 3rd April 2020

Let’s start with the basics – what is rebalancing?

It’s the act of returning your investment portfolio back to the original target allocation we agreed with you – for example, Balanced 50 or Growth 80.

Over the past few years, rebalancing has often meant selling growth assets (equity-like) and buying defensive assets (bonds). This stops the portfolio becoming dominated, over time, by the riskier growth assets and helps to do three key things:

1.Keeps you within your emotional tolerance for market falls

2.You stay within your financial capacity to weather market falls

3.Adjusts your portfolio according to your need to take market risk in the first place

So, why are we talking about this now?

Humans have a hard time being investors. Normally, we like to purchase things when they’re cheap and avoid them when they’re expensive, but that’s often not the case for equities.

We tend to get overly optimistic when equity markets rise dramatically – as they have done since the 2008 financial crisis. Yet when markets fall materially, we feel bruised and cautious, seeking to hang onto our stable bonds and even selling equities to avoid further falls in portfolio value. That’s rarely a good idea, especially if you don’t need to access your funds in the foreseeable future.

Logically, the reverse also applies; at times like these when stock markets fall, the proportion of equities in your portfolio will have fallen below their long-term target. This is important because it means your portfolio will have too little risk – making it harder for the growth assets to recoup the falls in value when markets recover.

Let’s look at some examples…

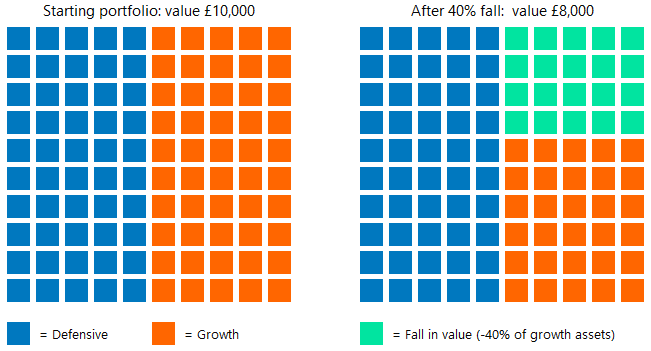

Imagine you own a £10,000 portfolio split 50% (£5,000) into growth assets and 50% into defensive assets. In the growth assets portion, you own 50 units of a global equity fund priced at £100 per unit. Growth assets fall by 40%. Let’s assume your defensive assets are unchanged in value. You still own 50 global equity fund units, but they’re now priced at £60. Your growth-defensive split has moved from 50/50 to 37.5/62.5. Time to rebalance.

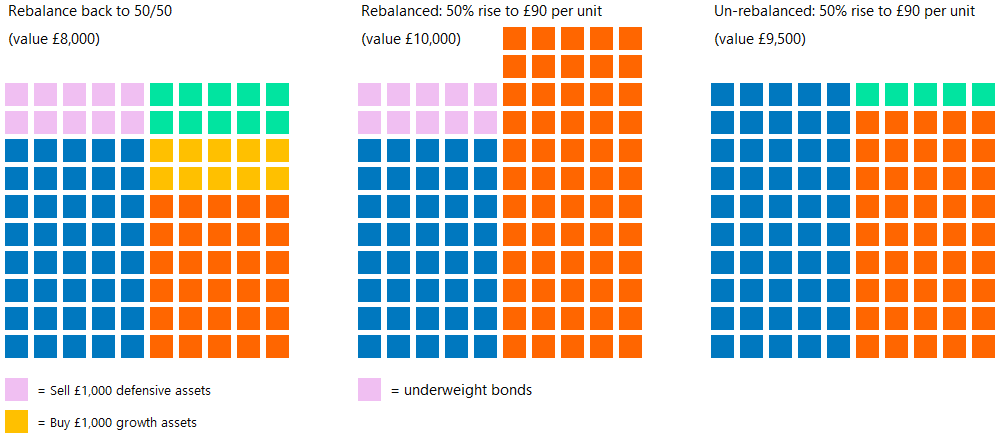

So, let’s now assume that you rebalance by taking £1,000 from your defensive assets and buying growth assets to get you back to a 50/50 split (left hand grid below). You can buy 16.7 units at £60 with the £1,000 raised. To get your portfolio back to its starting value of £10,000 your now 66.7 global equity units need to rise 50% to £90 per unit (middle grid). However, an un-rebalanced portfolio (right hand grid) only rises to £9,500 with this 50% rise. In fact, to get back to a portfolio value of £10,000 an un-rebalanced portfolio requires a rise of 67% in the global equity units to £100.

The ultimate question: should I rebalance?

As we continue to work with you throughout the current period of market volatility, we might speak to you about rebalancing – hopefully this blog helps you to understand why. Even if the markets fall again after rebalancing, you’ll have the opportunity to do it again.

We understand that this takes a strong stomach and discipline – when your emotions are most likely telling you to do the opposite. But don’t worry, that’s what we’re here for!

Remember as well, if you’re drawing an income from your portfolio, withdrawing the income from the bond element only can get you back closer to your target allocation. Likewise, if you’re thinking of adding cash to your portfolio, this too can be used to buy the growth assets.

We remain very close to the portfolios we manage and the daily changes in markets – if we feel a rebalance is right for you, we will be in touch.

As ever, please feel free to contact us if you have any questions or would like to talk anything through.

Past performance can’t guarantee what investments will do in the future. The value of a portfolio can go down as well as up, so there’s a chance you’d get back less than you put in.