Nov 3, 2022 | EWAN ROSIE

So far, it’s been a challenging year for investors. In what is historically a rare occurrence, both stock markets and bond markets have suffered losses.

Effective portfolio construction often includes a mix of equities (stocks) and bonds. Taking into account an investor’s risk profile and investment objectives. The idea being to balance out growth and defensive assets. This is an approach we favour. The media and academics like to reference this type of investment as the ‘60/40’ portfolio. Typically 60% in the stock market and 40% in bonds.

We’re experiencing a year where stock and bond markets are down. Largely due to a number of political, inflationary and interest rate pressures. As a result some journalists and investors question whether the 60/40 portfolio is dead. This is where it’s beneficial to ignore the noise and trust your plan.

It’s important for investors to focus not solely on where returns have been, but also where they could be going in the future.

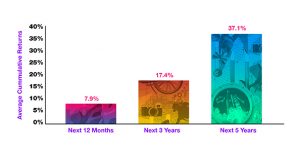

Dimensional Fund Advisers have reviewed the performance of a 60/40 portfolio following a decline of at least 10% in a year since 1926. They found that returns on average have been strong in the subsequent one-, three- and five-year periods. Demonstrated in the graph below for the period 1926 to 2022.

Source: Dimensional, “60/40 down, but not out”

60/40: 60% S&P 500 Index, 40% Five Year US T-Notes. January 1926 – September 2022.

History makes a strong case for investors to stick with their longer-term plan. And should serve as a reminder that steep market declines shouldn’t derail investors’ progress towards reaping the expected benefit of investing.

Markets have proven to be resilient over the long term. Like a boxer stepping inside the ring, investors should expect (and prepare) to take a few shots and get pushed up against the ropes every so often. The most important thing is to roll with the punches and not get knocked out by short term moves.

If history is any guide, there is still reason to believe in the methodology behind a 60/40 portfolio. It’s well placed to deliver the returns of an individual’s financial plan.

Past performance can’t guarantee what investments will do in the future. The value of a portfolio can go down as well as up, so there’s a chance you’d get back less than you put in.

Send an email to us at theteam@cooperparry.com