Mar 4, 2022 | EWAN ROSIE

As the terrible events in Ukraine continue to unfold, it’s unsurprising that we’re also seeing global stock markets react negatively to such awful circumstances. The financial cost (let alone the human cost) is currently unknown, hence the volatility in markets.

Naturally, this leads to investor uncertainty and speculation as to whether stock markets will continue to be volatile for a prolonged period, or whether we’re heading for a decline like we’ve never seen before.

Whilst no one can predict the future, financial history does provide some important insights into past stock market falls and what previous geopolitical/military action events have meant for stock markets.

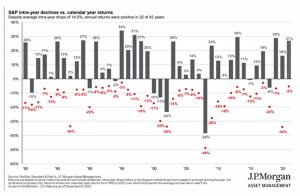

The chart above highlights the annual returns of the S&P 500 Index (US stock market), as shown by the grey bars. The red dots highlight the worst loss/decline point in each calendar year over the last 41 years.

What this is showing is that just because the stock market has a bad period (fall) during a year, it doesn’t necessarily mean the market will end the year negatively. Of course, this is a possibility, but history shows us that stock markets are resilient and reward the investors who stay the course.

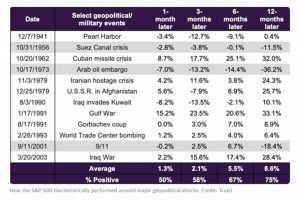

This time period also includes various geopolitical/war events, so let’s also look at such events and their specific impact on the stock market:

This research is also based on the S&P 500 Index and again highlights how resilient stock markets have been historically to events like we’re seeing now. Whilst there were three such events which led to sizeable market falls on a 12 months view, on a longer view the S&P 500 Index has more than recovered and moved on.

Both data sets demonstrate the best course of action for investors is to avoid making emotionally driven investment decisions, keep invested and think long term.

If you have any questions, please get in touch with your Relationship Manager.

Past performance can’t guarantee what investments will do in the future. The value of a portfolio can go down as well as up, so there’s a chance you’d get back less than you put in. This communication is for general information only and is not intended to be individual advice. You are recommended to seek competent professional advice before taking any action

Send an email to us at theteam@cooperparry.com