Jan 30, 2019 | EWAN ROSIE

We think it’s safe to say investment markets are going through a tricky period. So what better way to finish off our investment blog series than with some more detail about our sixth and final principle, ‘control your emotions and think long-term’.

As usual, pundits and commentators are putting recent market declines down to a variety of reasons. Brexit, European political and global trade tensions, aggressive US Federal Reserve policy and collapsing energy prices, to name a few. All this ‘noise’ makes for eye-catching headlines. Headlines that use scare tactics to draw people in.

At times like this we hear some common questions; “should we sit in cash for a period of time?”, “how long will the volatility last?” and “will the markets ever recover?”. Usually these are followed by; “if you decide to get out of the markets, how do you know when to go back in?”.

Given the negative headlines in the media, it’s no wonder investors battle with the behavioural and emotional side to investing.

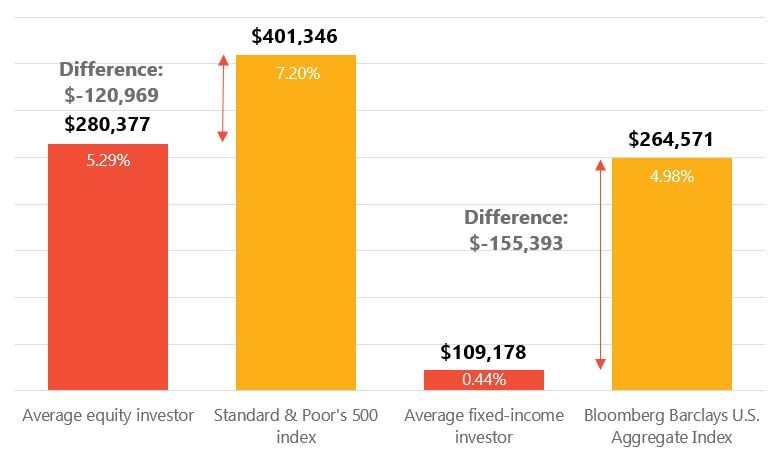

American financial research firm, Dalbar, assess this emotional battle each year. They compare what the average return equity and fixed income investors received in comparison to an appropriate benchmark index.

Dalbar look at a ten year period and use a hypothetical example of investing $100,000…

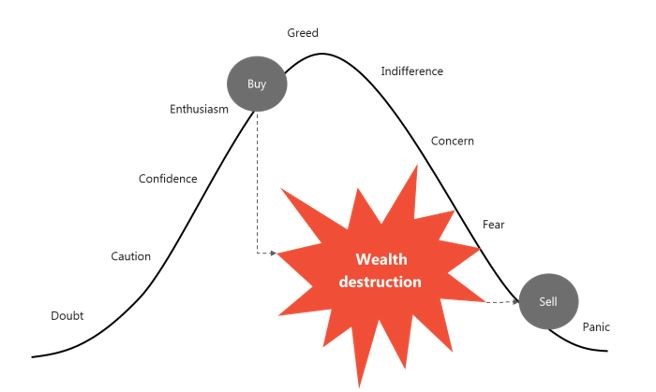

As you can see, the average investor received considerably lower returns than the indices. The study concluded that most investors give in to their emotions (often driven by media headlines) by trying to time going in and out of investment markets. This leads to buying high and selling low, i.e. wealth destructive behaviour!

Overall, the study continues to show that most investors are best served by staying invested over the long-term and by buying stocks and holding them for a long time, known as a buy and hold strategy.

Nobody knows how investment markets will perform in the short-term. Any bold predictions are simply guesswork, but we do know that over the longer-term, investment markets have almost always rewarded investors who have a globally diversified portfolio.

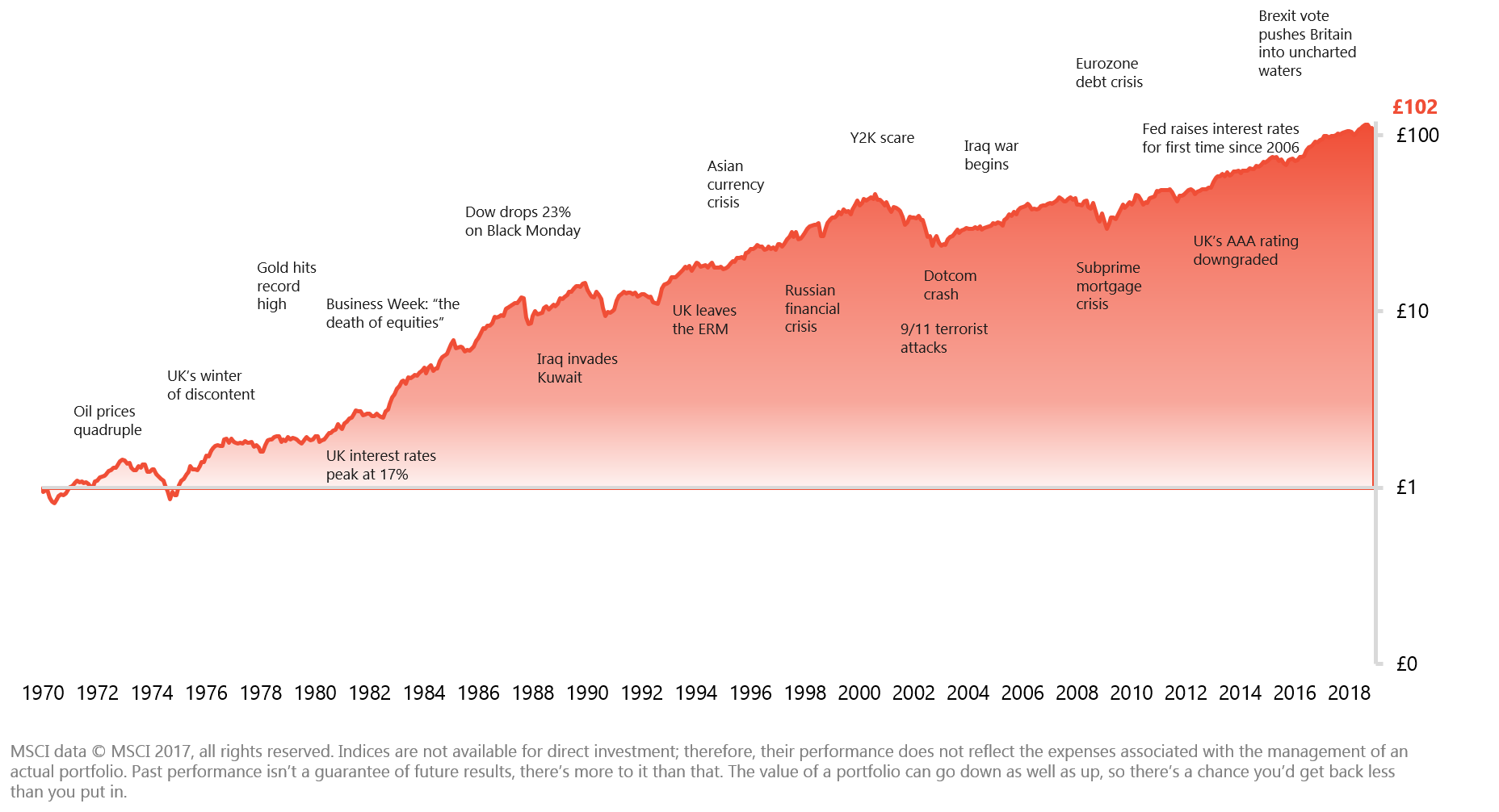

Historically the global stock market has proven to be very resilient. During tough conditions, whether it’s a stock market crash like Black Monday, the Iraq war, the dot com bubble, terrorist attacks or the banking meltdown – markets have always recovered and pushed forward, as shown below.

If you had invested £1 in the global stock market in 1970, it would’ve been worth £102 by the end of 2018.

In our ‘Keep your costs low’ blog we explained that part of our role is to actively coach and help clients with the behavioural challenges of investing. It’s our job to ensure your investments are set up correctly from a risk point of view, so you understand how short-term losses could affect you, as well as the positive gains you might receive. We do this by assessing risk in three ways:

1.What level of risk are you comfortable taking?

2.How much risk can you afford to take with your money?

3.How much risk do you need to take to achieve everything you want to?

Only by understanding these three aspects can an investment portfolio be structured appropriately. Get this right and you’re well on your way to managing the emotional battle of investing.

You can find out more about all six of our investment principles here.

The value of investments and the income from them can go down as well as up, and you may get back less than you originally invested. Past performance is not a guide to the future. The investments described are not suitable for everyone. This content is not personalised investment advice, and Cooper Parry Wealth can take no responsibility for investment decisions you may make as a result of this information.

Send an email to us at iant@cooperparry.com