Jul 11, 2022 | EWAN ROSIE

In our previous blog, we discussed whether it’s appropriate for an investor to regularly change their investment strategy based on their view of the market (tactical asset allocation). Or, whether you are better off sticking with an asset allocation over time.

The evidence was loud and clear; tactical asset allocation is not the best approach.

But what if you haven’t invested yet and are sitting on a large amount of cash? The volatile markets that we are currently experiencing can cause havoc with our emotions and can lead us to questionable decision making. The natural response is to say, “now isn’t the right time to invest”. But is this the correct position based on a history of markets?

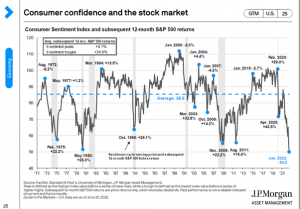

Consumer confidence is currently at a low. The following chart by JP Morgan looks at how the stock market has performed (S&P 500 Index) in the following 12-months after eight sentiment ‘peaks’ (highs) and eight sentiment troughs (lows).

Each blue dot is either a peak or a trough, and each point’s subsequent 12 month performance is noted underneath. In looking at the various peaks, the average 12-month return is 4%. In the eight sentiment troughs, the average following 12-month return is much greater at 25%.

This highlights one of the greatest behavioural challenges an investor faces. Whilst nobody can achieve market timing with any certainty, if you happen to be sat on cash when times are tough, history suggests that it is a favourable time to invest. However, actually doing this, is easier said than done.

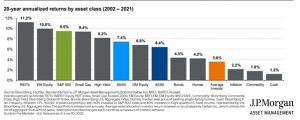

JP Morgan further highlights this point by looking at 20 year annualised returns by asset class between 2002 – 2021:

Asset classes in general have outperformed the average investor return over the last 20 years, by a large margin. The reason being bad, emotional decision making. At Cooper Parry Wealth, one of our key roles is to coach our clients towards making the right decisions with their money, often at the toughest of times.

If you are having trouble making decisions with your money at the moment, give us a call, and see how we can help.

Past performance can’t guarantee what investments will do in the future. The value of a portfolio can go down as well as up, so there’s a chance you’d get back less than you put in.

This communication is for general information only and is not intended to be individual advice. You are recommended to seek competent professional advice before taking any action.

Send an email to us at theteam@cooperparry.com