May 16, 2022 | EWAN ROSIE

So far, 2022 is proving to be a challenging year for all investment markets; a COVID lockdown again in China, the war in Ukraine, increases in inflation and interest rates, and now fears of stagflation – stagnation of economic output combined with high inflation. No wonder bond and stock markets are in turmoil!

At the most challenging times two of our key investment principles stand out and should be kept firmly in mind.

…..and diversify effectively. Our portfolios are spread over bonds, property and equites at an asset class level. They are also spread all around the world on a geographical basis.

The equity content is also diversified over differing types of companies, for instance, growth, value and smaller companies. When we look back over the last ten years or so, growth companies have had a fantastic run. Many active investment managers have increased their exposure to these stocks and are now seeing their funds fall back in value to below pre pandemic values.

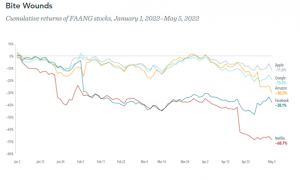

An example of growth companies are the FAANG stocks. FAANG represents Facebook, Amazon, Apple, Netflix and Google. These stocks have driven much of the US stock market performance and had a particularly good run through the initial COVID period of 2020. However, as the world is now a less restricted place, and with interest rates rising to tackle increases in inflation, these companies have taken a hit as shown below:

Source: DFA article – “Have the Tech giants been De-FAANGed?”

This shows the danger of being overly reliant on a small number companies, and with it a particular type of stock.

Whilst effective diversification can’t ensure that your portfolio doesn’t fall in value during any shorter period of time, it can soften the blow, which is what we have seen lately in our portfolios.

When investment markets are falling, it’s understandable that you may become anxious. This is normal! However, remember that we’ve been through a financial planning exercise that has concluded the best mix of growth and defensive assets for you to ensure you stick with the plan even when times get tough, giving you the best chance of achieving your long term objectives.

Investment markets have a solid history of rewarding the long term investor. But there are always challenges along the way. So it’s important to keep disciplined at these times as emotional human behaviour, selling as markets fall, is the biggest destroyer of wealth.

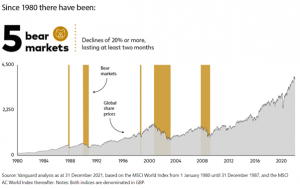

Periods of stock market downturns are normal, as shown by the below chart.

Dramatic market losses can sting, but it’s important to keep your long term perspective, stay invested and then benefit from the recovery that will follow. Whilst some bear markets have been sharp, many recoveries or bull markets (market increases) have been even sharper, and have lasted longer.

Trying to time these events is guesswork, and the best advice is to stay the course, stick to your long term plan and ignore the inevitable negative noise that comes from the media during these times.

If you have any questions, or need any reassurance, please contact your Relationship Manager.

This communication is for general information only and is not intended to be individual advice. You are recommended to seek competent professional advice before taking any action. Past performance can’t guarantee what investments will do in the future. The value of a portfolio can go down as well as up, so there’s a chance you’d get back less than you put in.

Send an email to us at theteam@cooperparry.com