Jul 19, 2020 | JONATHAN ELSIGOOD

‘It is not necessary to do extraordinary things to get extraordinary results.’

A quote from Warren Buffett – perhaps the world’s most renowned investor. He’s worth $71.5 billion today* but achieving that level of wealth hasn’t necessarily been easy.

He’s always valued the power of capitalism and set out to accumulate wealth over time with discipline, patience and fortitude. It’s not the only thing we have in common…

1.Being different doesn’t scare him. He famously avoided tech stocks in the 90s because he didn’t ‘get’ them

2.He detests high fund management costs that reduce the returns investors should be benefiting from

3.The long game is the only one for him

So, what do we mean when we say it hasn’t been easy for him? $71.5 billion in the bank sounds pretty nice to us! But when you look at the numbers, Buffett didn’t ‘beat’ the market as you might expect. He kept things simple, chose discipline in the face of setbacks and most importantly invested over a long period of time.

Why is the long game so important?

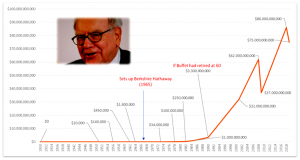

Buffett has been investing for almost three quarters of a century. By 32 he was worth just shy of $2 million – he’s now almost 90, has legendary status and billions in the bank! Instead of choosing to retire at 60, when he would’ve been worth under 5% of his net worth today, he stuck it out.

Take a look at the chart below to see how the long game has played out for him…

Warren Buffett’s wealth – born in 1930 and still going strong

So, as you can see it’s the length of time that Buffett stayed invested that has made him so successful!

Riding out underperformance

Beating the market has become harder over the years – in the early days, there were fewer research analysts and fund managers in the market and a far higher level of amateurs playing the game. But Buffett wasn’t playing. He had a plan and he stuck to it!

This is evident when you look at Buffett’s listed investment holding company, Berkshire Hathaway, which suffered 17 years of underperformance.

Buffett remained steadfast in his approach to investing. He didn’t jump ship after a handful of ‘bad’ years.

Lessons to learn

We’re all capable of having a plan and sticking to it. There may well be years of underperformance and emotional challenges but as we said at the start of this blog – we can do extraordinary things by keeping things simple and advocating the same long-term, patient approach as Buffett.

*Yahoo 2019

Past performance can’t guarantee what investments will do in the future. The value of a portfolio can go down as well as up, so there’s a chance you’d get back less than you put in.